New Tax Regime 2024 – As the tax benefit is now foregone for an individual opting for new tax regime, he/she needs to evaluate afresh investment decision based on three fundamental principles of safety , liquidity and . In Belgium, the land of chocolate, waffles and exorbitant rates of taxation, the expat tax dream is over. This month, the country’s special expatriate tax regime — available to people hired from .

New Tax Regime 2024

Source : cleartax.in

Aiat Institute on X: “Income Tax Slab For FY 22 23 AY 23 24 Call

Source : twitter.com

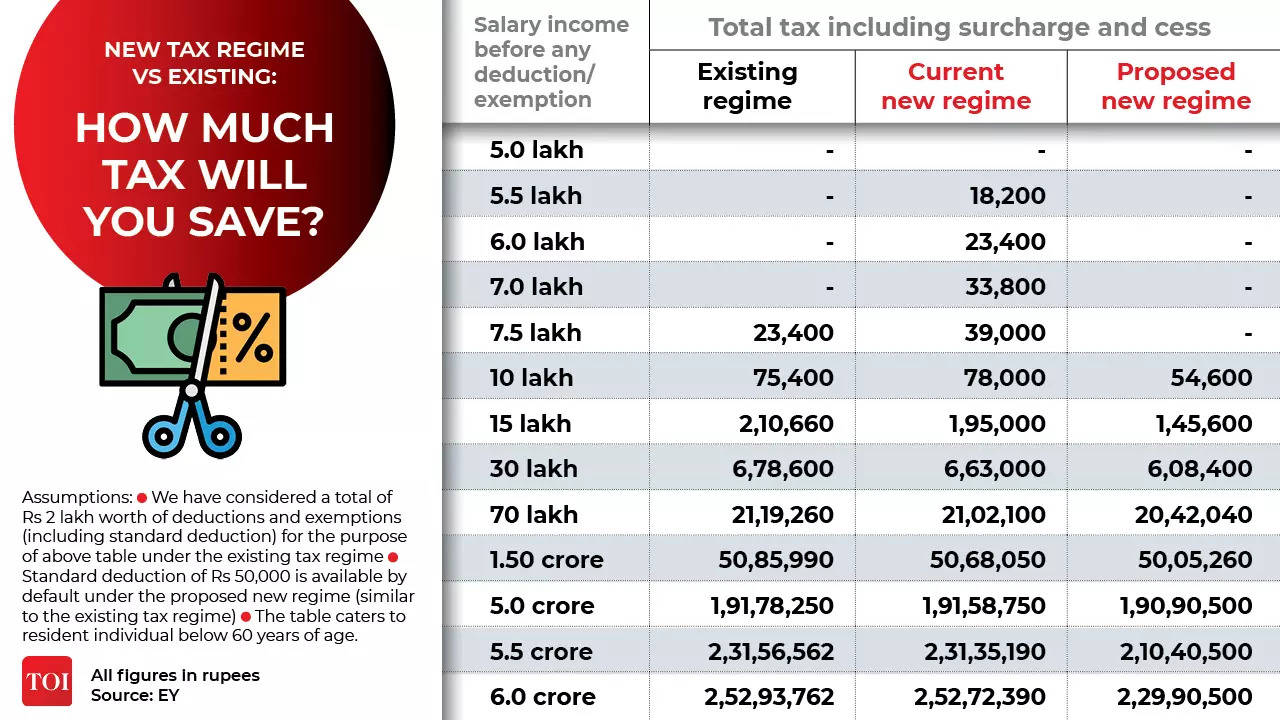

Budget 2023 Income Tax Slabs Savings Explained: New tax regime vs

Source : m.timesofindia.com

Income tax calculation examples Archives FinCalC Blog

Source : fincalc-blog.in

Health Insurance Tax Benefits FY 2023 24 (AY 2024 25) | Sec 80D

Source : www.relakhs.com

New tax slabs, no tax on income up to Rs 7 lakh in new tax regime

Source : m.economictimes.com

Brief comparison between New Tax Regime and Old Tax Regime; FY

Source : studycafe.in

What is tax slab for new tax regime u/s 115BAC for AY 2023 2024 Old

Source : www.linkedin.com

New Vs Old Tax Slabs FY 2023 24: Which is Better + Free Calculator

Source : stableinvestor.com

Tax calculation on salary AY 2024–25 | New Tax Regime Deductions

Source : medium.com

New Tax Regime 2024 Income Tax Slabs FY 2023 24 and AY 2024 25 (New & Old Regime Tax : While the New Tax Regime was portrayed as beneficial for individual taxpayers because of reduced slab rates, it has not gained full acceptance among the individual assessees. . We do not expect any major announcements for tax mobilisation and rationalisation, but some tinkering with the new concessional tax regime cannot be fully ruled out, Emkay Global Financial .