Child Tax Credit For 2024 Filing Year – “Federal student loan borrowers who were required to continue student loan payments starting in the fall of 2023 could qualify to deduct up to $2,500 of student loan interest per tax return per tax . Here is what you should know about the child tax credit for this year’s tax season and whether you qualify for it. .

Child Tax Credit For 2024 Filing Year

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024: Will there be a Child Tax Credit in 2024

Source : www.marca.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

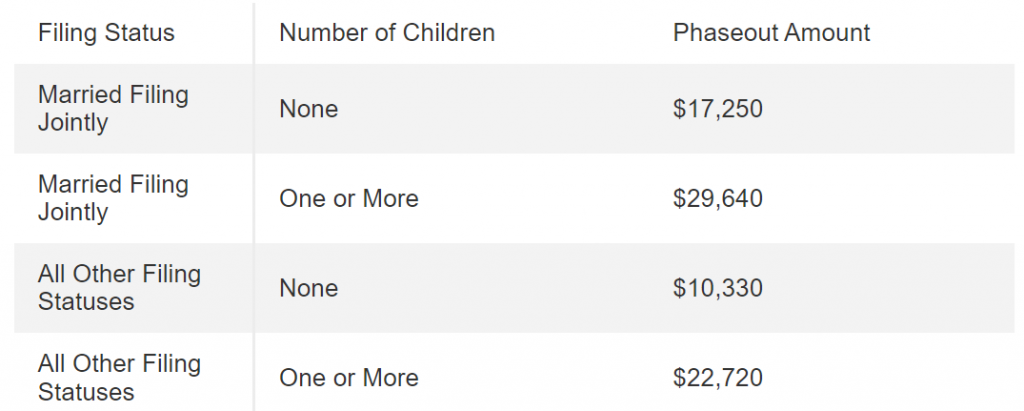

Child Tax Credit For 2024 Filing Year Here Are the 2024 Amounts for Three Family Tax Credits CPA : People filing in 2024 are filing for the year 2023. T he Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children . Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)